Beware of scams! UCU will never call and ask for sensitive information. If you're ever unsure who you're speaking with, hang up immediately and call us at 800.UCU.4510.

Aggie Strong. Future Focused.

In Davis, the spirit of sustainability and innovation drives everything. UCU mirrors that future focus with financial tools for students starting out, professors and staff building security, and alumni shaping the future across Northern California. From campus fields to global leadership, we’re here to keep the Aggie community thriving.

Supporting UC Davis students, professors, staff, and alumni across Northern California.

- Across the Aggie Community. Faculty planning retirement, staff balancing family budgets, students starting out, serving every member of the Davis ecosystem.

- Rooted in NorCal. UC Davis leads in agriculture and sustainability; UCU leads with financial solutions just as future-focused.

Make it official!

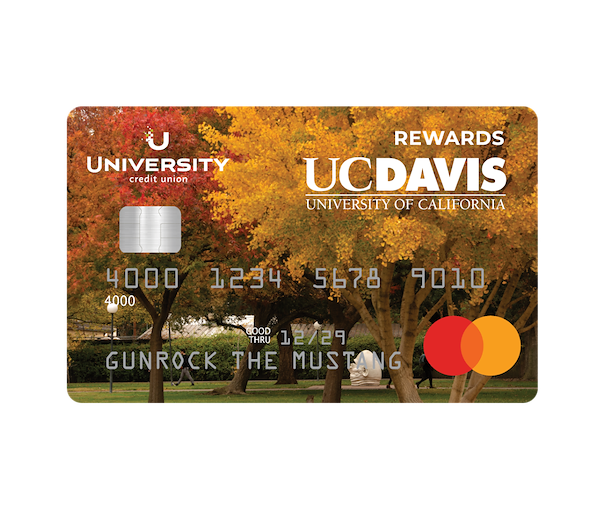

Bank with Aggie pride when you pay with the official Aggie Rewards credit card — only from University Credit Union!

- No annual fee

- Earn 2 points for every $1 spent on all purchases*

- There is no limit on the rewards you can earn

- Redeem points for travel, gift cards, merchandise, Mastercard® prepaid cards, eCertificates, and more

- Experience enhanced security benefits and features powered by Mastercard®

The UC Davis Aggie Loan.

University Credit Union – the official financial services partner of UC Davis – is proud to offer the Aggie Loan, a special loan opportunity exclusively for the UC Davis community.

Designed with your unique needs and aspirations in mind, the Aggie Loan provides the financial support you need to achieve your goals, backed by one of the best rates in the country, guaranteed1.

Bank smarter, not harder.

University Credit Union's Smart Checking offers a strong rate, minimal fees, and a suite of premier features designed to maximize your financial advantage.

- Up to 2.50% APY²

- No monthly service fees or overdraft fees

- Free ATM access on campus & 30,000+ CO-OP ATMs nationwide

- Official Aggie debit card!

UC Davis Banking Hub

Certified Credit Union Financial Counselors (CCUFC) are available virtually as well as on-campus to help students, faculty, and staff navigate financial questions and concerns. Book an appointment, today, for a free coaching session with a dedicated financial expert.

The UCU Banking Hub is located on-campus at UC Davis.

Bank on your terms.

Bank anywhere with University Credit Union's secure digital platform. Manage accounts, transfer funds, pay bills, and access powerful tools to achieve your financial goals—all from your phone, tablet, or computer.

Digital banking

University Credit Union's top-rated mobile app puts a full suite of digital banking services, including mobile check deposit, Bill Pay, and card management, right in your hand.

Digital banking

Mobile wallet

Enjoy secure, convenient, and seamless spending by adding your University Credit Union debit card to your mobile wallet. Pay at registers, order ahead, or checkout—no card needed.

Mobile wallet

Meet Royce

Royce is an AI (artificial intelligence) powered digital assistant that can answer questions, help you find resources on our website, provide account information, facilitate transactions, and more.

Meet Royce

*Rewards Credit Card offers a generous 2 points per dollar spent on net new purchases (purchases less any credits, returns, disputed billing items, and adjustments). Cash advances, balance transfers, fees, finance charges, checks, or other transactions that we determine not to be eligible used to access your account will not earn rewards points. Not all members will qualify. There is no limit on the rewards points you can earn each month. Any determination of qualifying transactions and exceptions for rewards points is at the sole discretion of University Credit Union. University Credit Union reserves the right to verify and adjust rewards points at any time prior to or following point posting and redemption. Points are not earned until they appear on the billing statement. If the Rewards Credit Card account is closed, all points not redeemed will be lost. Rewards points are not transferable. University Credit Union may change or terminate the Rewards Program at the credit union's discretion at any time, with or without prior notice except where required by law.

1UCU guarantees that our lowest loan rate for cars, credit cards, consumer loans, and HELOCs are in the top 5% nationwide as measured in a monthly rate survey by Rate Watch, a part of S&P Global. Rates are subject to approval and based on an evaluation of credit history and other factors specific to your loan (such as loan term, credit score, loan amount, loan-to-value, and length of credit) and may be higher than the lowest rates advertised. Rates are subject to change at any time.

2APY = Annual Percentage Yield. To earn 2.50% APY, member must have a qualifying Smart Checking Account. Based on a combined rate of 2.472%. All accounts must be in good standing with no delinquency or bankruptcy pending. Qualifying Smart Checking Accounts will earn 2.50% APY in dividends on balances up to $25,000. Balances above $25,000 will be paid at the regular checking rate.

Qualifying Smart Checking Accounts are defined as being enrolled in eStatements and having a direct deposit to the Smart Checking Account of at least $1,000 aggregated monthly. If the requirements are not met, then no dividend is earned. Secondary Smart Checking Accounts not eligible to earn APY. Dividends are calculated by the daily balance method, which applies a daily periodic rate to the balance in the account at the end of each day. Dividends are disbursed monthly into the active Smart Checking Account. APY is accurate as of the last dividend declaration date. Fees could reduce the earnings on the account. Rate subject to change after account opening and may vary based on qualifications met at month end. Not valid with any other offers. To establish a University Credit Union Membership, you must deposit at least $5 to a Regular (Share) Savings Account. A $50 minimum deposit is required to open a Smart Checking Account. All accounts are subject to approval.